Insurance

5 Essential Factors to Consider for Your openhouseperth.net Insurance

In the dynamic urban landscape of Perth, safeguarding your property with the appropriate insurance coverage from openhouseperth.net is essential for navigating life’s uncertainties. Whether you’re a homeowner or an investor, understanding the nuances of insurance policies is pivotal for securing your investment and attaining peace of mind. Amidst the daily hustle and bustle, having reliable insurance acts as a safety net, offering protection against unforeseen events and potential risks. However, to ensure comprehensive coverage that aligns with your needs, it’s imperative to consider several essential factors.

First and foremost, assessing the extent of coverage is paramount. Openhouseperth.net insurance offers various policies tailored to different property types, ranging from standard homeowner’s insurance to specialized coverage for rental properties or investment portfolios. Understanding the specific protections each policy provides is crucial for making informed decisions about your insurance needs.

Additionally, evaluating the policy limits and deductibles is vital. While higher coverage limits offer greater protection, they often come with increased premiums. Finding the right balance between adequate coverage and affordability is key to optimizing your insurance investment. Similarly, considering deductible amounts is important, as it determines the out-of-pocket expenses you’ll incur before insurance coverage kicks in.

Furthermore, examining the details of coverage is essential for identifying any exclusions or limitations that may impact your protection. From natural disasters to liability coverage for accidents, understanding what is included—and what isn’t—can help prevent unpleasant surprises during claim settlements.

1. Understanding the Basics of openhouseperth.net Insurance

Openhouseperth.net insurance provides a range of policies designed to protect homes and belongings, catering to the unique requirements of homeowners and renters alike. Fundamental to effectively navigating these insurance options is grasping the basics. Coverage options serve as the cornerstone of any insurance policy, dictating what is protected and under what circumstances. These may include coverage for property damage, personal liability, additional living expenses, and even protection for valuable items like jewelry or electronics. Understanding these coverage options allows individuals to tailor their policy to suit their specific needs and concerns.

Another critical aspect to comprehend is the deductible amount. This refers to the out-of-pocket expense the policyholder must pay before the insurance coverage kicks in. Generally, policies with higher deductibles come with lower premiums, while lower deductibles lead to higher premiums. Thus, striking a balance between affordability and comprehensive coverage is essential.

Moreover, becoming acquainted with the terminology and intricacies of openhouseperth.net insurance empowers individuals to make informed decisions regarding their coverage. This includes understanding policy limits, exclusions, and any additional riders or endorsements that may be available to enhance protection.

2. Evaluating Coverage Options

When it comes to selecting openhouseperth.net insurance, the breadth of coverage options available presents a critical aspect of decision-making. Each policy type offers distinct protections tailored to meet varying needs, necessitating careful evaluation to align with individual circumstances effectively. Essential considerations include property value, location specifics, and potential risks prevalent in the area.

Standard policies typically encompass fundamental coverage for common perils such as fire, theft, and vandalism. However, for properties situated in regions prone to specific hazards like floods, earthquakes, or hurricanes, additional coverage may be necessary to mitigate these risks adequately. Understanding the unique threats faced by your property’s location is paramount in determining the extent of coverage required.

Comprehensive packages offer broader protection, encompassing a wider range of perils and often including additional features such as liability coverage or coverage for personal belongings. While these policies may come with higher premiums, they provide comprehensive peace of mind by safeguarding against a multitude of potential threats.

3. Assessing Risk Factors

Effective insurance planning hinges on the identification and mitigation of potential risks, making the assessment of risk factors a crucial step in selecting openhouseperth.net insurance. Every property faces a unique set of risks, ranging from natural disasters like floods, earthquakes, and bushfires to more commonplace hazards such as theft, vandalism, or accidental damages. Understanding these risks and their potential impact on your property is essential for crafting a comprehensive insurance policy that adequately safeguards your investment.

Conducting a thorough risk assessment involves evaluating various factors that could pose a threat to your home and belongings. This includes considering the geographical location of your property and its susceptibility to specific natural disasters prevalent in the region. For instance, homes situated in flood-prone areas may require additional coverage beyond standard policies to mitigate the financial ramifications of flood-related damages.

Furthermore, assessing the structural integrity and age of your property can uncover potential vulnerabilities that may increase the risk of damage or loss. Older homes, for example, may be more susceptible to issues such as plumbing leaks or electrical fires, necessitating enhanced coverage to address these concerns.

Collaborating with insurance professionals can provide valuable expertise and insights during the risk assessment process. These professionals can help identify potential gaps in coverage and recommend appropriate solutions tailored to your property’s unique risk profile.

By conducting a comprehensive risk assessment and leveraging the expertise of insurance professionals, homeowners can make informed decisions when selecting openhouseperth.net insurance. By proactively addressing potential risks and ensuring adequate coverage, individuals can mitigate financial exposure and enjoy greater peace of mind knowing their property is protected against unforeseen circumstances.

4. Reviewing Policy Details

Before committing to your openhouseperth.net insurance policy, a meticulous review of the fine print is imperative. This entails delving into the policy details with precision, focusing on crucial aspects such as coverage limits, exclusions, and claim procedures. By scrutinizing these elements, homeowners can mitigate the risk of encountering unexpected surprises should an unforeseen incident occur.

Understanding coverage limits is paramount, as it delineates the maximum amount the insurance provider will pay out in the event of a claim. Assessing whether these limits align with the value of your property and possessions ensures that you are adequately protected against potential losses.

Equally important is identifying exclusions within the policy—specific scenarios or circumstances for which coverage may be denied. By clarifying these exclusions upfront, homeowners can take proactive measures to address any gaps in coverage, such as purchasing additional endorsements or seeking alternative insurance solutions.

5. Securing Competitive Rates

While prioritizing comprehensive coverage is vital, securing competitive rates for your openhouseperth.net insurance is equally important. Shopping around and comparing quotes from multiple insurers can help you identify cost-effective options without compromising on coverage quality. Additionally, leveraging discounts and bundling options offered by insurers can further optimize your insurance investment.

Openhouseperth.net Insurance: Protecting Your Haven

Ensuring the safety and security of your home requires proactive planning and thoughtful consideration, and openhouseperth.net insurance serves as a cornerstone in this endeavor. By understanding the fundamental principles of insurance coverage, evaluating your options meticulously, and prioritizing risk mitigation strategies, you can safeguard your property with confidence. Remember, investing in openhouseperth.net insurance is not just about protecting your assets—it’s about protecting your peace of mind.

Conclusion

Investing in openhouseperth.net insurance is a proactive step towards protecting your most valuable asset—your home. By prioritizing thorough evaluation, proactive risk management, and informed decision-making, you can secure comprehensive coverage that offers both financial protection and peace of mind.

Read: Exploring the Benefits of Utilizing Craigslist Quad Cities for Buying and Selling

Insurance

Understanding Pennsylvania Attorney Malpractice Insurance: Protecting Yourself

As a Pennsylvania Attorney Malpractice Insurance, ensuring you have the right Pennsylvania Attorney Malpractice Insurance is crucial for protecting yourself and your practice. With the complexities of legal work, having proper coverage can provide peace of mind and financial security in case of unforeseen circumstances. Let’s dive into understanding Pennsylvania Attorney Malpractice Insurance to help you make an informed decision on safeguarding your career.

Table of Contents

The PBA Lawyers’ Professional Liability Insurance Program

The Pennsylvania Bar Association offers a specialized insurance program tailored to meet the unique needs of its members. The PBA Lawyers’ Professional Liability Insurance Program provides comprehensive coverage designed specifically for attorneys practicing in Pennsylvania. This program understands the specific risks that lawyers face in their daily work and aims to protect them from potential Pennsylvania Attorney Malpractice Insurance claims that could arise.

Members of the Pennsylvania Bar Association can benefit from competitive rates and customizable coverage options through this program. By participating in this insurance initiative, attorneys can ensure they have adequate protection against legal malpractice allegations, giving them confidence to focus on providing quality legal services to their clients. With the backing of the PBA, lawyers can access expert guidance and support when navigating the complexities of professional liability insurance.

Comprehensive Coverage for Pennsylvania Bar Association members

As a member of the Pennsylvania Bar Association, you have access to comprehensive coverage through the PBA Lawyers’ Professional Liability Insurance Program. This specialized insurance is designed to protect you in case of any claims or lawsuits alleging malpractice during your legal practice. It offers peace of mind knowing that you are safeguarded against potential financial risks and professional challenges.

The coverage provided under this program ensures that you are protected from various liabilities that may arise while fulfilling your legal duties. From negligence claims to errors or omissions in client representation, having this insurance can help mitigate the costs associated with defending yourself in court.

By being part of this program, Pennsylvania Bar Association members can focus on their legal work without constantly worrying about potential Pennsylvania Attorney Malpractice Insurance issues looming over their heads. It’s a valuable resource that supports lawyers in their daily practices and provides a safety net in case unforeseen circumstances occur.

Lawyers’ professional liability insurance carriers in Pennsylvania

When it comes to protecting yourself as a Pennsylvania attorney, choosing the right professional liability insurance carrier is crucial. There are several carriers in Pennsylvania that offer lawyers’ professional liability insurance tailored to meet the specific needs of legal professionals in the state.

These insurance carriers understand the unique challenges and risks that attorneys face in their daily practice. They provide comprehensive coverage options to safeguard against potential malpractice claims and lawsuits.

By partnering with a reputable insurance carrier, Pennsylvania attorneys can have peace of mind knowing that they are protected financially in case of any unforeseen circumstances or allegations of negligence.

It’s important for attorneys to research and compare different carriers to find one that offers competitive rates, excellent customer service, and strong financial stability. Working with a reliable carrier ensures you have the support you need when it matters most.

ABA Resources for Legal Pennsylvania Attorney Malpractice Insurance

Navigating the world of legal malpractice insurance can be overwhelming for Pennsylvania attorneys. Thankfully, the American Bar Association (ABA) offers valuable resources to help lawyers understand and secure the right coverage.

The ABA provides guidance on choosing a reputable insurance carrier, understanding policy options, and ensuring adequate coverage limits. Attorneys can access informative articles, webinars, and tools to enhance their knowledge of malpractice insurance.

By leveraging the ABA’s resources, legal professionals in Pennsylvania can make well-informed decisions to protect themselves from potential risks and liabilities. Whether you’re a seasoned attorney or just starting your practice, utilizing these resources can be instrumental in safeguarding your career and reputation.

Stay informed and proactive when it comes to legal malpractice insurance by tapping into the wealth of information available through the ABA. Protect yourself and your practice with expert guidance from trusted sources in the legal industry.

Considerations for Purchasing Legal Malpractice Insurance

When it comes to purchasing legal malpractice insurance in Pennsylvania, there are several key considerations to keep in mind. It’s essential to assess the specific needs of your law practice and determine the level of coverage required. This includes considering factors such as the size of your firm, areas of practice, and potential exposure to risks.

Additionally, researching different insurance carriers is crucial. Look for insurers that specialize in providing coverage for attorneys in Pennsylvania and have a strong reputation within the legal community. Reading reviews and seeking recommendations from fellow lawyers can also help you make an informed decision.

Another important factor to consider is the cost of premiums versus the level of coverage offered. While affordability is important, it’s equally crucial not to compromise on quality protection for your practice. Understanding the policy terms, limits, deductibles, and exclusions will ensure you select an insurance plan that aligns with your needs.

Don’t forget about customer service and claims handling when choosing an insurer. Opt for a provider known for their responsive support and efficient claims processing procedures. By carefully weighing these considerations, you can secure reliable malpractice insurance that safeguards your legal practice effectively.

Mainstreet Legal Malpractice Insurance in Pennsylvania

Are you a Pennsylvania attorney looking for reliable malpractice insurance? Look no further than Mainstreet Legal Malpractice Insurance. With their specialized coverage options tailored to the unique needs of legal professionals in the state, Mainstreet offers peace of mind and protection against potential risks.

Mainstreet’s comprehensive policies are designed to safeguard attorneys from claims of negligence or errors that could result in financial losses or reputational damage. By partnering with Mainstreet, lawyers can focus on serving their clients confidently, knowing they have a trusted insurance provider backing them up.

Mainstreet understands the complexities of the legal field and strives to provide top-notch customer service and support throughout the insurance process. Their team is dedicated to helping attorneys navigate the intricacies of malpractice coverage and find solutions that meet their specific requirements.

Don’t leave your practice vulnerable – choose Mainstreet Legal Malpractice Insurance for reliable protection in Pennsylvania.

Benefits of choosing Mainstreet for legal malpractice coverage

Looking for reliable legal malpractice coverage in Pennsylvania? Consider the benefits of choosing Mainstreet Insurance. With their specialized focus on serving attorneys, Mainstreet understands the unique needs and challenges that legal professionals face in their practice.

Mainstreet offers customizable coverage options tailored to individual attorney requirements, ensuring comprehensive protection against potential malpractice claims. Their competitive rates make it accessible for attorneys of all sizes and specialties to safeguard their practice without breaking the bank.

Additionally, Mainstreet provides exceptional customer service, offering prompt assistance and guidance throughout the insurance process. This personalized approach sets them apart from other providers, establishing a trusted relationship with each policyholder.

By selecting Mainstreet for your legal malpractice insurance needs, you can have peace of mind knowing that your practice is well-protected by a dedicated team committed to supporting your success in the legal profession.

Conclusion

When it comes to practicing law in Pennsylvania, having attorney malpractice insurance is not just a recommended precaution – it’s a necessity. The legal landscape can be complex and unpredictable, making it crucial to protect yourself from potential professional liabilities.

By understanding the options available through programs like the PBA Lawyers’ Professional Liability Insurance Program and carriers like Mainstreet Legal Malpractice Insurance, Pennsylvania attorneys can ensure they have comprehensive coverage tailored to their specific needs.

Whether you are a solo practitioner or part of a larger firm, investing in quality malpractice insurance provides peace of mind and safeguards your professional reputation. So, take the time to explore your options, consider all relevant factors when purchasing coverage, and select an insurer that offers the protection you need.

Remember, attorney malpractice insurance is not just about meeting requirements – it’s about safeguarding your future as a legal professional in Pennsylvania.

-

Education3 months ago

Education3 months agoThe Versatility of Poster Boards: A Comprehensive Guide

-

Blog3 months ago

Blog3 months agoUnveiling the Enigma of “λιβαισ”: A Comprehensive Exploration

-

Game3 months ago

Game3 months agoUnraveling the Mystery: What is Kalyan Satta Matka – Kalyan Tips & Learning Math?

-

Celebrity3 months ago

Celebrity3 months agoTahaad Pettiford: Unveiling the Enigma

-

News4 months ago

News4 months agoDigital News Alerts: The Ultimate Tool for Instant Updates and Breaking News

-

Technology3 months ago

Technology3 months agoNitter: The Privacy-Focused Alternative to Twitter

-

Technology3 months ago

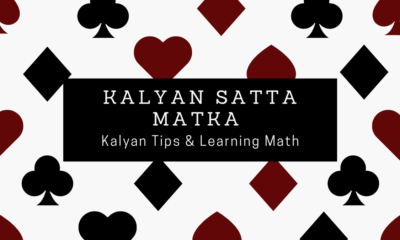

Technology3 months agoThe Power of Strip Charts: How They Enhance Data Visualization

-

News3 months ago

News3 months agoIs Kisskh.me Down? Unraveling the Mystery